Market Trends of LFP Battery

Wood Mackenzie’s latest report shows global energy storage capacity could grow at a compound annual growth rate (CAGR) of 31%, recording 741 gigawatt-hours (GWh) of cumulative capacity by 2030.

The global residential energy storage market is projected to reach USD 17.5 billion by 2024 from an estimated USD 6.3 billion in 2019, at a CAGR of 22.88% during the forecast period.

LFP to overtake NMC as dominant stationary storage chemistry by 2030.

Global Energy Storage Trends

Wood Mackenzie’s latest report shows global energy storage capacity could grow at a compound annual growth rate (CAGR) of 31%, recording 741 gigawatt-hours (GWh) of cumulative capacity by 2030.

Energy storage is still a nascent market, a relatively new investment class with underlying risks. The stakeholders – whether end-consumers or big equity investors – are interested in continuing to invest in the sector and do not appear to be hindered by the pandemic and economic recession impacts.

Supportive policies, ambitious climate commitments, and the growing need for flexible resources are common drivers.

Home Energy Storage Trends

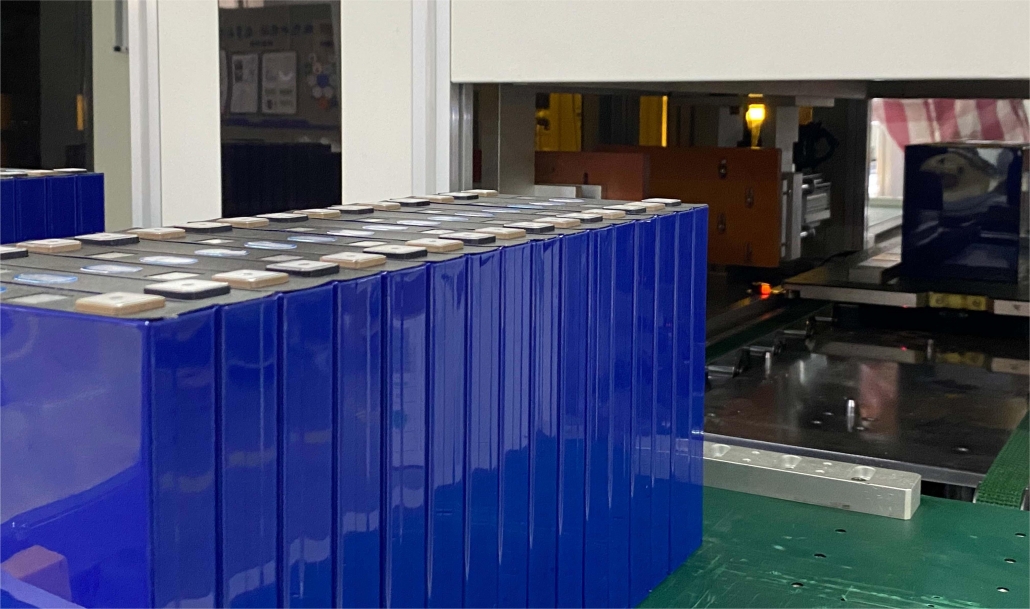

Leading LFP Battery

Lithium-iron-phosphate (LFP) is poised to overtake lithium-manganese-cobalt-oxide (NMC) as the dominant stationary storage chemistry within the decade, growing from 10% of the market in 2015 to more than 30% in 2030, according to new analysis from Wood Mackenzie.